Something You Didn’t Know About Depreciation – What are our strangest depreciation requests this tax season?

It’s the time of year when we take a deep breath and reflect on the tax season that was.

Most of the Depreciation Schedules we do are on what we think of as ‘vanilla properties’. That doesn’t refer to the colour, more that they are standard residential or commercial properties with few surprises.

Then there are the properties we do that are less vanilla, and more the sort of whacky flavours that ice cream shops dream up these days.

Our favourite this year was the boat. A big one.

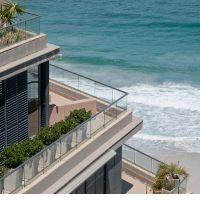

We also had a client who won a beachfront block of apartments in a lottery. Yes, it really does happen.

There was the fish farm.

And the property that consisted of a reception area and numerous rooms each with an ensuite bathroom and generous bed – one of them circular.

We do thousands and thousands of Depreciation Schedules every year on every imaginable property and have done for over 20 years. And we do them quickly – if you have a tax return you’re keen to submit ASAP, get in touch using your link.

Key Points

- Our client with a commercial charter boat was pleasantly surprised to learn the boat is considered plant and equipment.

- We had a lucky lottery winner come to us with a beachfront block of apartments he won requiring Depreciation Schedules.

- There is more depreciation in a Fish Farm than you would expect – it’s all in what you can’t see that makes the depreciation here worthwhile.

- A house of ill-repute – one with lots of beds and lots of bathrooms – can have a big Capital Works claim.

The Boat…

The Boat…

Ah, that boat. It was a large, company owned charter boat. The sort of boat that can roam the world. The sort of boat that makes quantity surveyors wistfully ponder their career choices.

The enquiry came in from a long term client. He had recently completed a $600K renovation on what we thought was a commercial property.

It turned out to be a refurbishment on a yacht that his company had purchased last year and was intending to use for charters.

But what surprised him?

All the costs were available for the refurb, so that wasn’t a problem. And we have done lots of Depreciation Schedules for that client so he knew what we needed to know. What surprised him was that we told him the whole boat was an item of Plant and Equipment. An item with a cost base of over $4m and an Effective Life of 15 years. A tad too much for the client to avail themselves of the Instant Asset Write-Off, but a huge annual claim with depreciation on the $600K refurb being the icing on top.

We took our time with that inspection and pondered stowing away.

The Lottery…

The Lottery…

You know those lotteries where people can win a house and a boat and goodness knows what else for a $10 ticket?

They have always seemed a bit ‘out there’ and improbable.

They’re not.

We know because a client bought a couple of tickets in one of those lotteries and won it.

He got a brand new block of four apartments on the beach, furniture, some beach toys, and strangely $500K in gold bullion. Surely that bullion was in a bank vault and not sitting on the coffee table when they gave him the keys?

It all made our fee seem embarrassingly modest.

We did Depreciation Schedules on three of the properties that the client was renting out. He had sought advice on that. And he had the properties valued individually to establish a cost base should decide to sell a couple down the track.

Maybe he’ll buy a big boat then.

Are you thinking about buying a ticket in a lottery next time an offer comes into your inbox?

The Fish Farm…

The Fish Farm…

We have done a few fish and prawn farms over the years and did another one recently.

According to our quantity surveyors, they’re more pleasant than doing a chicken farm – better smell.

They don’t look terribly substantial from a depreciation perspective – not surprisingly there are huge ponds and just a few buildings.

But these operations can have huge depreciation claims.

There is the odd modest boat and some portable machinery, but it’s what you can’t see that holds the depreciation. Those huge ponds are lined and that liner has an Effective Life.

There are also inevitably submerged pumps. Big ones. And plenty of them.

And the buildings that sometimes appear a bit ramshackle from the outside often conceal substantial freezers and cold processing rooms.

Depreciation is often not obvious.

The House of Ill Repute….

The House of Ill Repute….

We’ve also done a few jobs in establishments where a building, often a commercial building, has been converted to a property with multiple bedrooms. All with ensuites.

Bathrooms are an expensive room and when a property has over a dozen with lots of marble, there can be a big Capital Works claim.

Lots of money in those beds, too. And the many mirrors.

One client not so long ago argued that he thought he should be entitled to claim the Capital Works deduction at 4% under the short term traveller provision. We told him that probably would not wash with the ATO. His argument was that people rarely stayed longer than an hour in his establishment. He was going to seek advice and we told him we could adjust the Depreciation Schedule down the track.

We also had a client recently who needed us to break down the fitout on their recently and expansively renovated ‘adult’ store.

We suggested to our reluctant QS that it might be an idea to show up brazenly at opening time carrying a coffee and wearing a hi vis vest perhaps to avoid being mistaken for a customer – he was going to need to spend a fair bit of time there.

Enquire now for a property-specific assessment

Enquire now for a property-specific assessment

Has this article reminded you about a client’s investment property? Residential properties, commercial properties, even farms, we do them all.

If you want us to talk to a client about a Depreciation Schedule, make a no-obligation enquiry and rely on our 20-plus years of experience in estimating depreciation returns.